New “Cost-Effective” Plan Could Reduce CO2 Emissions by 20% – However, It Still Costs Billions of Dollars

Significant economic changes are essential to counter climate change, yet they risk substantial economic disruptions. A new dual-factor approach by the Complexity Science Hub aims to balance emissions reductions with economic stability by assessing both CO2 emissions and systemic economic impacts, as demonstrated in a detailed Hungarian case study.

A recent study from the Complexity Science Hub explores strategies for implementing climate policies with minimal impact on the economy.

According to the Intergovernmental Panel on Climate Change (IPCC), a “rapid and far-reaching change” is required to prevent catastrophic climate change.

“However, the transformation of the economy towards climate neutrality always involves a certain amount of economic stress — some industries and jobs disappear while others are created,” explains Johannes Stangl from the Complexity Science Hub (CSH). When it comes to climate policy measures, how can economic damage be minimized?

A CSH team has developed a new method to help solve this problem. “To understand how climate policy measures will affect a country’s economy, it’s not sufficient to have data on carbon dioxide emissions. We must also understand the role that companies play in the economy,” says Stangl, one of the co-authors of the study recently published in Nature Sustainability.

CO2 emissions reduced by 20%

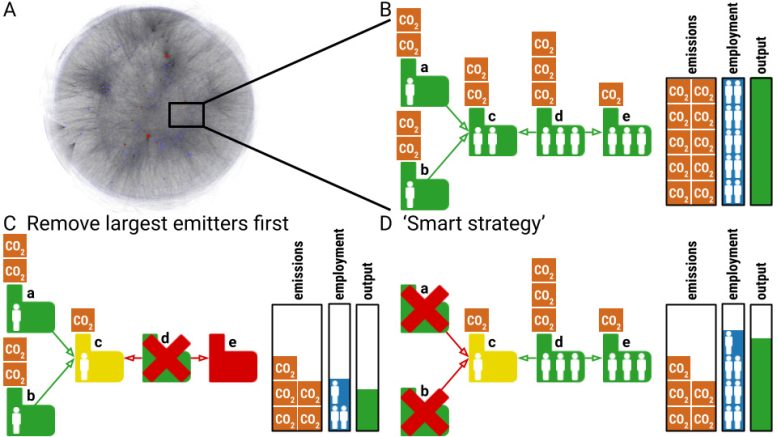

The researchers used a data set from Hungary that includes almost 250,000 companies and over one million supplier relationships, virtually representing the entire Hungarian economy. They examined what a country’s entire economy would look like if certain companies were forced to cease production in various scenarios – all aimed at reducing greenhouse gas emissions by 20%.

(A) Hungary’s production network. (B) Micro-level diagram of a production sub-network consisting of five firms. Every firm employs people, produces economic output, and emits CO2 byproducts. The right-hand bars show the total emissions, number of jobs, and total output of the sub-network. (C) ‘Remove largest emitters first’ strategy. To effectively reduce emissions, firm d which is the largest emitter, is removed. Firm e loses its only supplier which causes it to stop its production and lay off its employees. Firm c loses one of its suppliers and reduces its production level by 50%. In total, CO2 emissions are decreased by 50% while jobs are cut by 70%, similar to economic output. (D) ‘Smart strategy’ based on the identification of decarbonization leverage points. By closing systemically irrelevant firms a and b, total CO2 emissions are reduced by 50% while jobs drop by just 30%. Total output is affected similarly. Since in this schematic figure a linear production function is assumed for all firms, only firm c is affected by a and b’s production stops. The ratio of emission savings per job loss is maximal for this second strategy. Credit: Complexity Science Hub

“In the first scenario, we looked at what would happen if only CO2 emissions were taken into account,” explains Stefan Thurner from the CSH. In order to reduce greenhouse gas emissions by 20%, the country’s seven largest emitters would have to cease operations. “In the meantime, however, around 29% of jobs and 32% of the country’s economic output would be lost. The idea is completely unrealistic; no politician would ever attempt such a thing,” says Thurner.

Furthermore, when greenhouse gas emissions and the size of the companies are considered, serious economic consequences result.

A two-factor approach

“Two factors are crucial – the CO2 emissions of a company, as well as what systemic risks are associated with it, i.e. what role the company plays in the supply network,” explains Stangl. CSH researchers developed the Economic Systemic Risk Index (ESRI) in an earlier study. It estimates the economic loss that would result if a company ceased production.

Taking these two factors into account — a company’s greenhouse gas emissions and its risk index for the country’s economy – the researchers calculated a new ranking of companies with large emissions relative to their economic impact.

According to the new ranking, a 20% reduction in CO2 emissions would require the top 23 companies on the list to cease operations. This, however, would only result in a loss of 2% of jobs and 2% of economic output.

At the company level

“In reality, companies would naturally try to find new suppliers and customers. We want to take this aspect into account in a further developed version of our model in order to obtain an even more comprehensive picture of the green transformation. However, our study clearly shows that we need to take the supply network at the company level into account if we want to evaluate what a particular climate policy will achieve,” say the authors of the study. This is the only way to assess which companies will be affected by a particular measure and how this will affect their trading partners, according to them.

The availability of company-level data has been largely lacking in Austria. The risk assessment is normally done at the sector level, for example, how severely a measure affects the entire automotive or tourism industry.

“This puts us at a disadvantage compared to other countries such as Hungary, Spain or Belgium, where detailed data is available at company level. In these countries, VAT is not recorded cumulatively, but in a standardized way for all business-to-business transactions, which means that extensive information is available on the country’s supply network,” explains Thurner.

Reference: “Firm-level supply chains to minimize unemployment and economic losses in rapid decarbonization scenarios” by Johannes Stangl, András Borsos, Christian Diem, Tobias Reisch and Stefan Thurner, 15 April 2024, Nature Sustainability.

DOI: 10.1038/s41893-024-01321-x

Funding: Bundesministerium für Klimaschutz, Austrian Science Fund, Österreichische Forschungsförderungsgesellschaft, Oesterreichische Nationalbank