Top Chinese research firm CEBM halts operations amid ‘nuclear winter’ in securities sector

CEO Qu Chen of the Shanghai-based consultancy told employees in a letter that they would all be placed on unpaid leave until the company can wade through the current turbulence. He did not give a timeline.

“The company has to make this hard decision to reduce costs,” he said in the letter dated August 5, which was seen by the Post. “Urgent actions must be taken to help us survive the ‘nuclear winter’ because some of the brokerage clients are unable to clear their accounts payable.”

“CEBM became the victim to a chain of bad reactions as the asset-management and brokerage industries took a beating from a slowing economy and a beleaguered stock market,” said Ivan Li, a fund manager at Loyal Wealth Management in Shanghai. “Business morale among securities industry employees appears to be low, and it will take some time before the fund managers, analysts and traders regain their confidence in the A-share market.”

CEBM could not be reached for comment.

Qu pledged in the letter that the employment status of staff members would be maintained despite the temporary halt to operations. The company would also continue paying into their pension and provident fund accounts, he added.

According to two fund managers briefed on the matter, CEBM’s capital crunch resulted from delayed payments by clients and dwindling sales after mainland China’s securities regulator set a cap on management fees collected by mutual-fund firms last year.

CEBM conducts economic research, studies commodity markets, analyses key industries and offers investment advice. Founded in 2005, it has about 50 employees, according to Tianyancha, which profiles financial companies.

The mainland’s top mutual fund management firm, China Harvest, is among CEBM’s clients. The firm is also a partner with Caixin, the mainland’s top financial media outlet, which compiles economic indicators such as the Caixin purchasing managers’ index, a gauge of China’s economic performance.

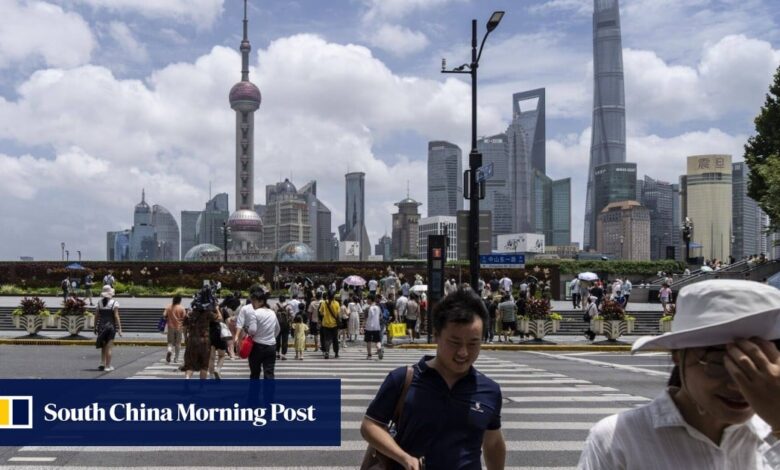

China’s stocks have been struggling to find a fresh catalyst as the nation’s economy struggles with headwinds from weak consumer spending and a lingering downturn in the property market. Demand for stocks has also been waning after a rebound triggered by state intervention ran out of steam as investors shifted their focus to growth prospects and corporate earnings. The CSI 300 Index is down almost 10 per cent from a high in May.

Source link