Plan issued for Independence Day celebrations – World Pakistan

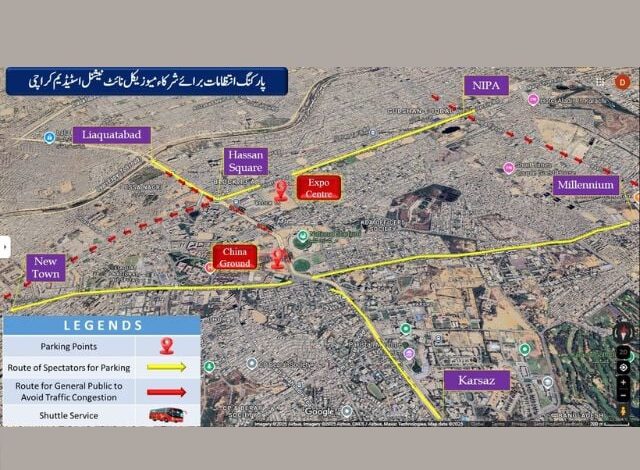

Karachi Traffic Police have announced a special traffic and parking plan for a Musical Night at the National Stadium on August 13, marking the 78th Independence Day and Marka-e-Haq celebrations.

Vehicles with official event stickers will be allowed entry via Gates 1 and 11, while general parking has been arranged at the Expo Centre and China Ground near the stadium.

Source: Karachi Traffic Police

Residents from District Central have been advised to access the Expo Centre through Hassan Square and use the shuttle service to the stadium.

Those from District South, East, and Malir should approach China Ground via Karsaz, New Town, or Rashid Minhas Road.

Authorities have warned of heavy traffic on Sir Shah Suleman Road, National Stadium Road, and Habib Ibrahim Rehmatullah Road (Karsaz) during the evening.

Alternate routes through University Road, Shaheed-e-Millat Road, Rashid Minhas Road, and NIPA have been suggested for commuters not attending the event.

Source link