Central Huijin, a unit of China’s US$1.2 trillion wealth fund, buys ETFs to boost stocks

Central Huijin Investment, a unit of China’s US$1.2 trillion sovereign wealth fund, bought exchange-traded funds (ETFs) on Monday, intervening in the nation’s stock market reeling from the fallout of reciprocal tariffs from the US.

The company is “firmly” positive on the outlook of China’s capital markets and fully acknowledges the allocation values of A shares, or the yuan-denominated stocks trading on China’s onshore exchanges, the statement said.

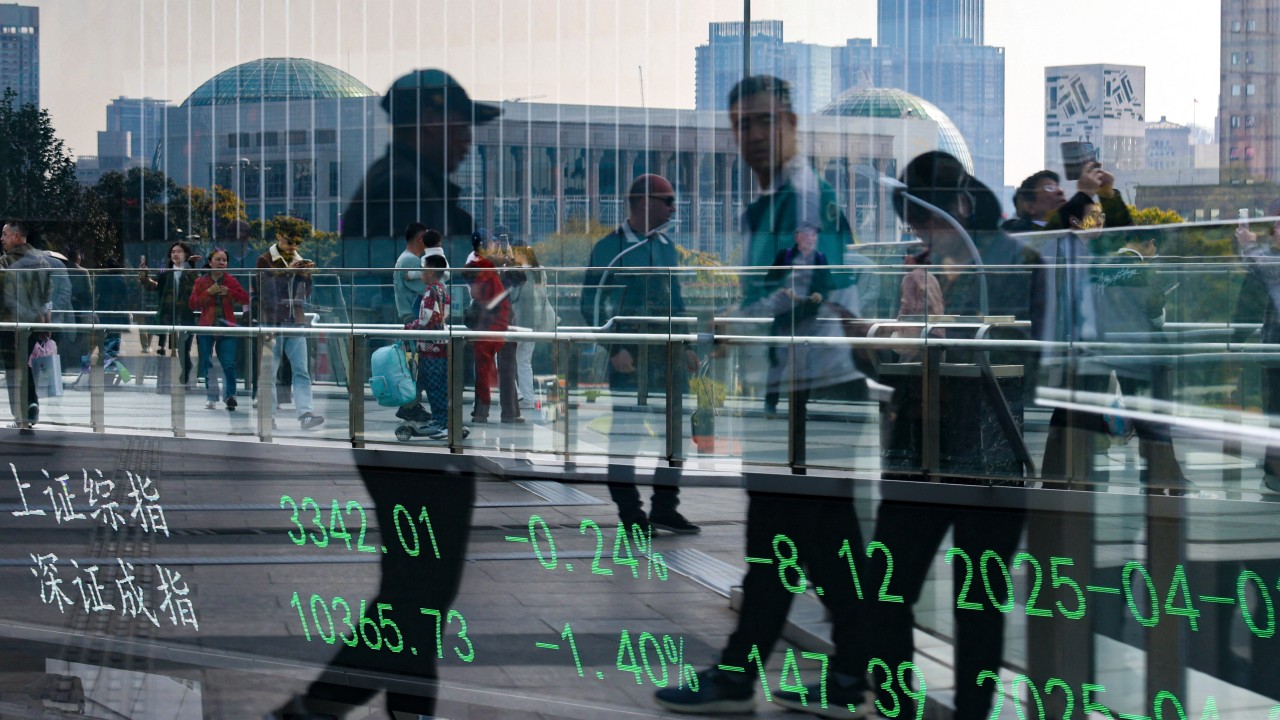

The re-emergence of state buying came after a sell-off deepened on Monday in reaction to US President Donald Trump’s 34 per cent reciprocal tariff on Chinese imports.

The CSI 300 Index tumbled 7.1 per cent, while a key gauge on the tech-heavy Shenzhen exchange slumped 11 per cent.

The latest buying comes more than a year after Central Huijin stepped in to the market in February last year.

Source link