Sovereign investors look to emerging markets as geopolitical tensions rise, says study

“Longer-term risks [geopolitical tension] have become more salient as inflation has fallen back towards central bank targets,” said Martin Franc, Invesco CEO of Asia ex-Japan in a statement.

“Meanwhile, elections across major markets over the past year have proven difficult to predict.”

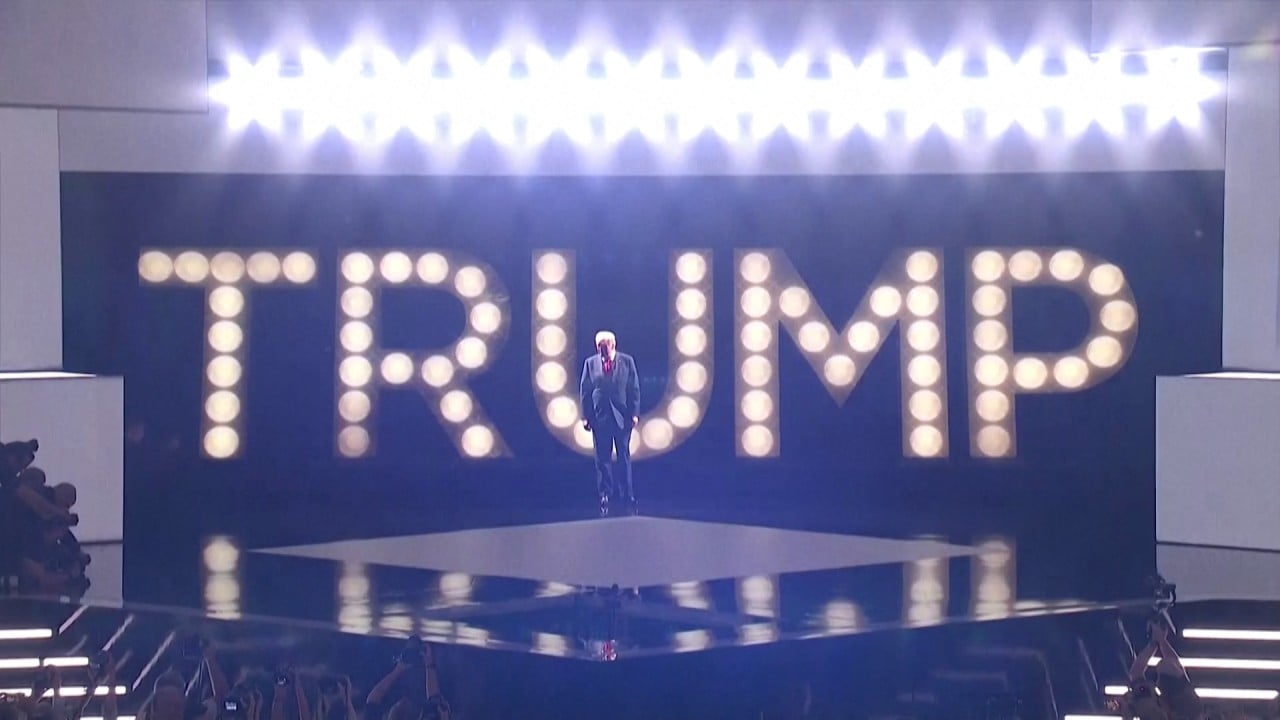

US President Joe Biden has just dropped his US re-election bid, prompting markets to worry the election in November may go the way of Donald Trump, who has warned he would increase tariffs on Chinese goods.

Central banks are worried the election outcome may trigger market volatility, currency fluctuations and changes in investor sentiment. This has prompted the central banks and sovereign funds to switch their investment to gold, which traditionally is a good hedging tool for volatile investment markets.

Some 53 per cent of the respondents said they wanted to increase the size of their gold reserves in the next two years, while 56 per cent of central bankers said they consider gold more attractive because of the geopolitical turmoil.

Gold prices rose 13 per cent this year to a record of US$2,435 per ounce in May, and many analysts expect the rally has not ended. Swiss lender Julius Baer expects the price to get up to US$2,600 per ounce in the next 12 months.

“For gold prices to push even higher from these levels, we believe both Chinese investors and the central bank need to return to the market,” said Carsten Menke, head of next generation research at Julius Baer in a research note last week. Menke believes both will continue to buy gold.

Tensions have also pushed sovereign investors and central banks to invest more in emerging markets. Some 54 per cent said they believe these markets will benefit from the geopolitical tensions worldwide, while 67 per cent anticipate that emerging markets will perform better than developed markets over the next three years.

Tension between the US and China is top of the list of concerns, which may benefit emerging markets such as India and Brazil, as manufacturers could opt for these markets to diversify their supply chains and production bases, according to the survey.

Some 88 per cent of sovereign investors are interested in increasing their exposure to Indian debt, up from 66 per cent in 2022. Countries such as Mexico and Brazil are seen as well-placed for US near-shoring, and are therefore becoming particularly favoured by Middle Eastern and Asian funds.

Private credit has emerged as an alternative to traditional fixed income, with 63 per cent of investors seeing it as an attractive diversification from traditional fixed income. Thirty-six per cent of sovereign investors reported better-than-expected returns from their private credit investments.

The study also revealed that the green energy transition is viewed as an increasingly attractive investment opportunity, with 30 per cent of sovereign investors and central banks considering it a high-priority allocation and a further 27 per cent holding some form of renewable or cleantech investments.

“Both renewable and conventional energy assets remain part of the allocation mix, and ongoing engagement with energy players will be an essential element in the transition journey to reach net-zero targets”, said Franc.

Source link