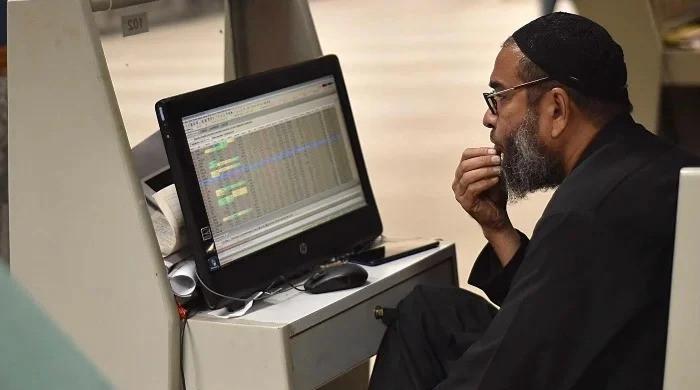

PSX kicks off week strong, boosted by macro stability

The capital market kicked off the week on a positive note owing to improving investor sentiment and a macroeconomic backdrop supportive for bulls.

Factors such as optimism about economic recovery, reduced geopolitical tensions, and accommodative monetary policies have driven the market higher.

The Pakistan Stock Exchange’s (PSX) benchmark KSE-100 Index on Monday gained 1,686.81 points, or 1.51%, to hit an intraday high of 113,037.98.

Despite volatility, the equities market achieved a partial recovery following a turbulent week previously. The benchmark KSE-100 Index settled at 111,351 points at the end of the last week, up 1,838 points, or 1.68% week-on-week.

Foreign investor transactions were still on a net selling side, with net selling of $6.8 million, mainly from the banking sector. This was offset by existing net buyers local individual investors and banks/DFIs, which softened the blow of foreign outflows.

The government managed to raise Rs913 billion via the latest auction of Treasury Bill (T-bill), but still couldn’t hit the target of Rs1,200 billion. Three- and six-month papers had cut-off yields of 11.99% unchanged, while 12-month cut-off yields were set at 12.29%. The reserves with the State Bank of Pakistan (SBP) fell by $228 million to $11.9 billion as repayments of external debt persisted.

Pakistan’s economic fundamentals are healthy despite the small decline in reserves. Imports fell 16.91% year-on-year in November and exports rose 17.56% year-on-year, resulting in a current account surplus of $729 million in November, the highest in a decade, while FY2024-25 exports in the first five months grew 12.57% year-on-year. It also reports a 31% increase in foreign direct investment (FDI) during this time.

Analysts also remained upbeat as the KSE-100 Index posted a return of 78%, making it the second-best performance of any stock market in the world. Topline Securities forecasts a strong 55.5% return for 2025, fueled by solid earnings from the fertiliser and banking sectors and cash flows improving for exploration and production firms.

The PSX is expected to maintain its positive momentum in 2025, provided continued political stability, ample liquidity, and a positive shaping of economic policies.

The PSX is trading at a price-to-earnings (PE) ratio of 6x and provides significant upside potential in a macro environment that is stabilising.