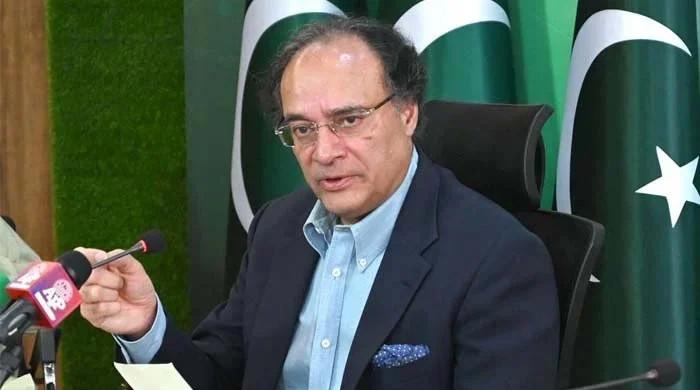

Pakistan to issue $200m Panda Bond by June: Aurangzeb

The federal government has planned to launch Panda Bond by June this year to increase Pakistan’s footprint in Chinese equity markets, Finance Minister Muhammad Aurangzeb said.

“Pakistan plans to raise approximately $200 million from Chinese investors through the issuance of the Panda Bond,” the finance minister said in an interview with a Hong Kong news channel.

His remarks come as the Prime Minister Shehbaz Sharif-led government strives to expand the tax net and increase revenue generation to fulfil the conditions and targets set out by the International Monetary Fund (IMF) as part of the $7 billion Extended Fund Facility programme approved last year.

“This step is part of a broader strategy to transition Pakistan’s economy towards export-driven growth, with a focus on achieving sustainability in the country’s balance of payments,” he emphasised.

He also highlighted the critical importance of the second phase of the China-Pakistan Economic Corridor (CPEC).

The finance minister said that the second phase of CPEC would attract more Chinese companies and also open avenues for increased investments.

He invited Hong Kong businessmen and the government to explore trade and financial opportunities in Pakistan.

The minister opined that Hong Kong could serve as a strategic hub for joint ventures between Chinese and Pakistani companies.

Last week, in an interview with Bloomberg Television on the sidelines of the Asian Financial Forum in Hong Kong, Aurangzeb said: “The country is very keen to tap the Panda bonds and the Chinese capital markets. We have been remiss as a country not to tap it previously.”

The country is considering raising $200 million to $250 million from Chinese investors over the next six to nine months which is slightly lower than the $300 million previously aimed by the minister who added that China International Capital Corporation was advising Islamabad on the issuance of Panda bonds.

The country has witnessed some positive changes in the economic indicators such as the rise in foreign exchange reserves which reached a three-year high of $18.7 billion in November 2024.

With remittances reaching $3.1 billion in December, marking a 29.3% year-on-year increase on one hand, the country’s growth forecast has also been revised to 3% during the fiscal year 2024-25 as opposed to the previous figure of 2.8% projected in September 2024 by the Asian Development Bank (ADB).

Meanwhile, the State Bank of Pakistan (SBP) reduced the policy rate by 200 basis points (bps) to 13% — the lowest in two years — and is further expected to slash it in the policy meeting scheduled this month as reported by The News.

Speaking on the improved economic indicators, Aurangzeb had said that the country was currently in the “phase of stabilisation” and would then have to focus on sustainable growth.

Source link