New report reveals the top 10 smartphone makers of Q2 2024: Who’s up and who’s down?

These are the top 10 smartphone manufacturers in Q2 2024

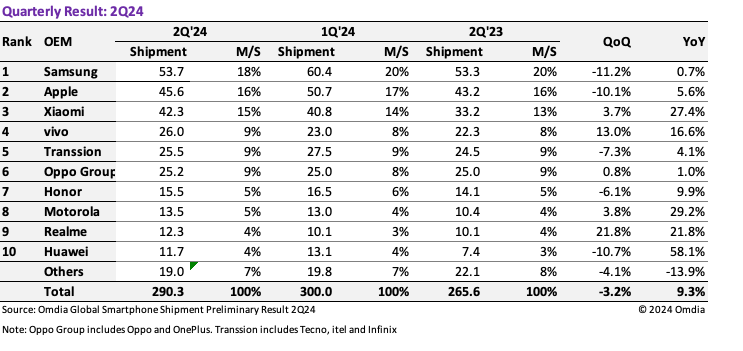

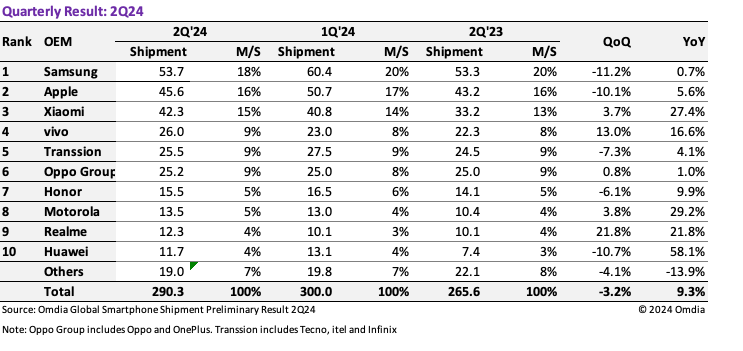

According to Omdia’s latest preliminary report, 290.3 million smartphones were shipped in the second quarter of 2024. This marks a 9.3% increase compared to the same period last year, following an 11.5% rise in the first quarter of 2024 and an 8.6% increase in the last quarter of 2023. However, it’s a slight dip of 3.2% compared to the first quarter of this year.This slower growth suggests that the smartphone market is stabilizing after a big boom between late 2020 and mid-2021 and a slump in 2022. In this year’s Q2, many brands like Xiaomi, vivo, Motorola, Realme, and Huawei saw big jumps in shipments, while Apple had more modest gains.

The latest quarterly results reveal the current trends and shifts in the smartphone market.

Samsung topped the charts with 53.7 million units shipped in Q2 2024, a slight 0.7% increase from the same period last year but an 11.2% drop from Q1 2024, mostly due to seasonal factors and the fact that Q1 was pretty successful for the Korean tech giant. An earlier report from Counterpoint Research showed Samsung leading the global market in the first quarter of 2024, shipping one in five phones worldwide during that time.

But now, Samsung seems to be hitting some bumps, especially in the mid-range market, which is where it sells most of its phones.

Recently, the smartphone market has been experiencing accelerated polarization, with the mid-range market shrinking while the proportion of low-end and high-end markets is increasing. Accordingly, while brands with a high proportion of low-end and high-end smartphones are increasing their shipments, brands with a high proportion of mid-end smartphones are struggling.

– Jusy Hong, Senior Research Manager in Omdia’s Smartphone group, August 2024

After a dip in the first quarter, Apple bounced back with a 5.6% year-over-year growth in Q2 2024. The company shipped 45.6 million units, up from 43.2 million in Q2 2023 but down from 50.7 million in Q1 2024. This decline isn’t unusual since the second quarter is usually the slowest. While Apple’s overall shipments rose compared to last year, shipments in China actually went down compared to the same period last year.

As for the rest of the top 10 smartphone makers this Q2, it goes like this:

- Xiaomi: Saw a 27.4% year-over-year increase, shipping 42.3 million units in Q2 2024, up from 33.2 million in the same period last year. This is a slight 3.7% rise from the previous quarter but indicates a continuing recovery in market share.

- vivo: Moved up to fourth place with 26.0 million shipments this Q2, a 16.6% increase from 22.3 million in Q2 2023 and a 13% rise from the previous quarter.

- Transsion: Shipments have stayed pretty steady, edging up from 24.5 million in Q2 2023 to 25.5 million in Q2 2024.

- Oppo: Recorded 25.2 million shipments, up 1% year-over-year, with growth driven by increased overseas shipments despite a drop in the Chinese market.

- Honor: Shipped 15.5 million units in the second quarter of 2024, marking the fourth consecutive quarter of year-over-year growth with a 9.9% increase.

- Motorola: Shipped 13.5 million units, a 29.2% increase, climbing to eighth place in the OEM rankings.

- Realme: Increased shipments to 12.3 million this quarter, up 21.8% from both Q1 2024 and Q2 2023, thanks to a sales boost in the Indian market.

- Huawei: Despite a decline from the previous quarter, shipped 11.7 million units in Q2 2024, a significant 58.1% year-over-year increase, largely due to new product launches like the Mate 60 Pro and Pura 70 series.

With shipments still rising, though at a slower pace, it is clear the market is maturing – no big surprise there. However, what I think is more interesting is the growing polarization in the industry. We are seeing a stronger focus on both entry-level and flagship phones, while the mid-range segment seems to be getting squeezed out.

If this trend keeps up, it could impact users in a few ways. For starters, there might be fewer choices in the mid-range price range, which usually offers a solid mix of features and affordability. Instead, people might have to pick between budget-friendly phones with basic features or splurge on high-end flagships with the latest tech at a higher price. But we will have to wait and see if that actually happens.

Source link