Samsung Galaxy Watch 7 review: slightly refined, but falls short on battery life promises

Intro

This year, Samsung has made the distinction between all of its Galaxy Watch models much clearer. If you want a big smartwatch with two day battery life, you should get the new and pricier Samsung Galaxy Watch Ultra.

Galaxy Watch 7 new features

- New Exynos W1000 processor

- 32GB storage, up from 16GB

- Galaxy AI-powered fitness and wellness suggestions

- New and more accurate BioActive sensor

- New metrics, such as an AGEs index

Table of Contents:

Design & Sizes

Same-ish design, no rotating bezel (sad face)

Two physical buttons, so you interact mostly by swipes and taps (Image by PhoneArena)

- 40 mm – 40.4 x 40.4 x 9.7 mm, 28.8g

- 44 mm – 44.4 x 44.4 x 9.7 mm, 33.8g

The bezel around the circular watchface is, again, touch-sensitive — you can navigate the UI either by swiping on the screen or along the edge of it. But this is not a physically rotating bezel, which is a shame.

You get a magnetic charging cable in the box (Image by PhoneArena)

Screen sizes are 1.3 inches for the 40mm model and 1.5 inches for the 44mm one. AMOLED panels, of course, and with Always On functionality.

There are no changes in peak brightness, which means still 2,000 nits for the Galaxy Watch 7. That’s not bad at all and we wouldn’t say we had any trouble viewing the Galaxy Watch 7 outside. Still, we have to mention that some watches can reach 3,000 nits.

We also get the usual IP68 rating and 5ATM rating, which means the Watch 7 should survive just fine at up to 50 meters underwater. However, keep in mind that 5ATM is still not good enough for extreme pressure or fast water flow, so aggressive diving or putting it under strong water jets is not advised. In my time testing the watch, I did a few open water swim workouts and had absolutely no issues with water.

Bands

The new Ripple band by Samsung is extra durable (Image by PhoneArena)

The Galaxy Watch 7 inherits the band-latch mechanism from the previous model. You have a button that you press to release the strap and then reattach it again. It’s simple enough, but if you’ve trimmed your nails a bit more you might have trouble pressing that button. Good news is that you can still use standard 20mm straps with spring bars.

The Watch 7 comes with a selection of new, colorful Ripple bands. We like the attention to detail and loved the provided sporty strap. The green color was nice and not boring with the stitching on the side, plus it seems extra durable.

Software & Features

Galaxy AI on your wrist?

Galaxy Watches have been rocking Wear OS for a while now. Samsung and Google came together, mixed up Tizen with Android, and came out with a smartwatch platform that took the best of both worlds. But you know, Samsung must be Samsung, so the Wear OS on Galaxy Watches has an extra skin on top, called One UI Watch.

So, the software here is One UI 6 Watch on top of Wear OS 5. It comes with new Galaxy AI features for the Watch 7 — it will analyze sensor data and deliver personalized health information, workout routine suggestions, and a holistic look at your wellbeing.

GPS, Heart Rate (HR) sensor and Workouts

The HR sensor accuracy is still not perfect (Image by PhoneArena)

The big change here is called “dual-band GPS”. Hooray for that! This is great especially for athletes that work out in big cities, where GPS pick-up might be poor. Dual-band ensures much better accuracy.

I have used the Galaxy Watch 7 for running and cycling, and found GPS accuracy to be quite good, but not perfect. Occasionally, the track would stray off for no apparent reason, so there is still room for improvement.

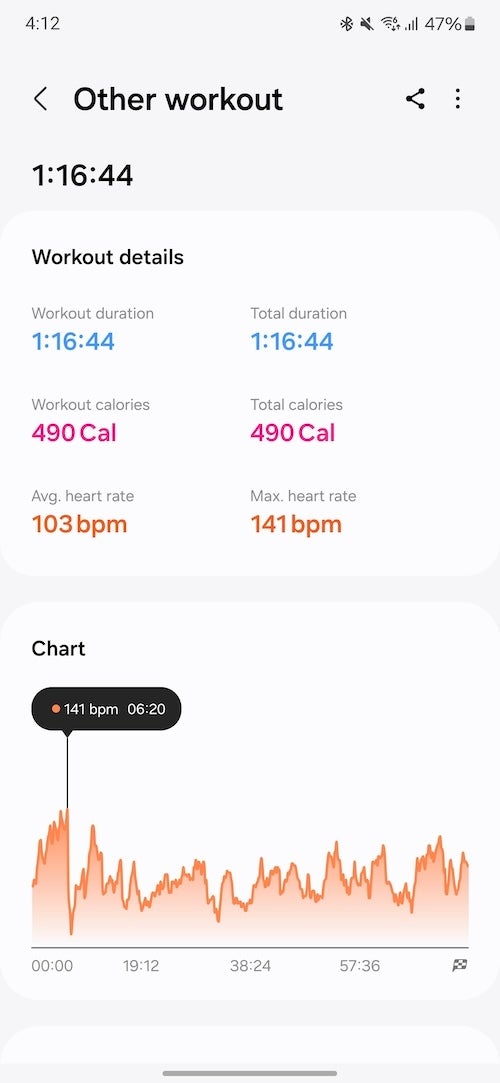

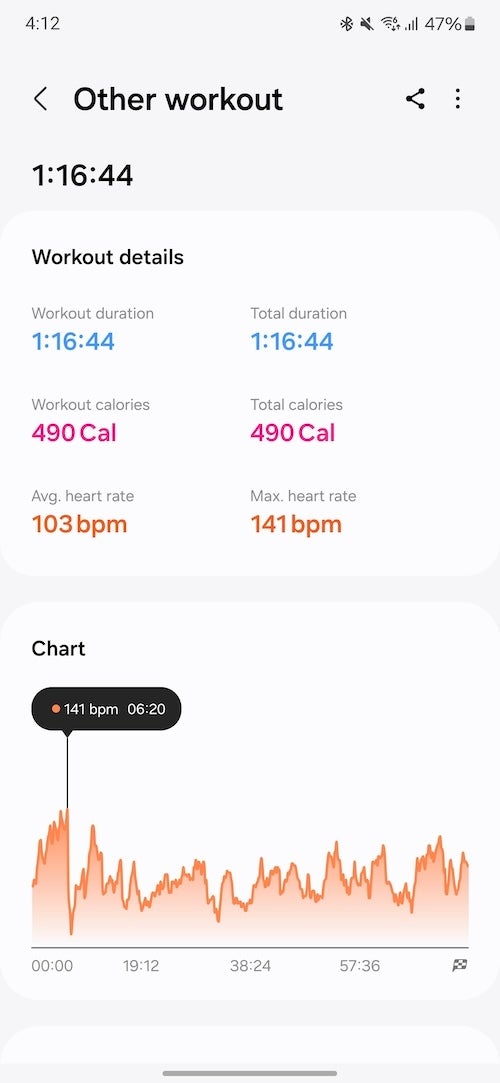

The Galaxy Watch 7 detected heart rate of over 140bpm during my warm-up, not even remotely true (notice the sudden drop right after that)

I am also not seeing a huge improvement with heart rate accuracy. In my experience with the previous Galaxy Watch 6, errors with heart rate measurements were common. In the example above, the watch detected a heart rate of over 140bpm when I was just warming up for a calisthenics workout, not even remotely accurate. Other watches and a heart rate strap show that I barely exceed 100bpm in those conditions. There are some occasional blips with other workouts as well. While HR accuracy is not the worst out there, Samsung still has ways to improve.

What I absolutely love, though, is how Samsung presents all of its workout data. Runners should be especially happy as they get quite a few metrics with proper explanations that make them all easy to understand and digest. Other companies like Garmin could definitely take a note or two in how the data is presented.

For those who do work out regularly — a new Race feature will continuously track your routine and measure it against past performances in real time. Essentially, you will be racing against a recording of yourself from last time, to give you that extra bit of motivation.

Sleep Tracking and Energy Score

Know your energy score (Image by PhoneArena)

The sleep tracker is now a Sleep AI Algorithm with new metrics for movement during sleep, sleep latency, heart and respiratory rate — these are all taken into account to give you a “sleep score” and help you improve on that habit. I love having this score and the breakdown for each night of sleep, and I wish rival Apple Watch would offer the same feature.

You probably, however, should not read too much into the data as it is not perfect. The Galaxy Watch tends to overcount awake time during the night, but it was quite good at detecting exactly when I felt asleep and when I woke up, which are the two most important numbers.

New is something Samsung calls Energy Score, which seems like a metric suspiciously similar to Garmin’s Body Battery.

Unlike Body Battery, though, your Samsung Energy Score does not change throughout the day, so it’s basically a value you get in the morning after you wake up. Samsung estimates this based on seven factors:

- Sleep time average

- Sleep time consistency

- Bed/wake time consistency

- Sleep timing

- Previous day activity

- Sleeping HR

- Sleeping HRV

You also get a separate score for each of these categories, so on my worst day when I got a score of 55, I could see that I had overexerted myself with more than three hours of activity the previous day, and my sleeping HR and HRV were only “fair”.

Speaking of HRV, Samsung’s estimates are wildly different (above) what I get from all other watches I have tested. On Garmin and Apple Watches my HRV values hover around the 40ms mark, while with the Samsung my values are often above 100ms, which seems wrong.

Advanced Health Metrics

There’s also an entirely new metric — advanced glycation end products (AGEs) index, which measures biological aging based on dietary habits and lifestyle. Whatever that means. Samsung does not provide an official explanation of how this works, so we are supposed to just kind of blindly trust the company. I found that very odd, so until Samsung explains it in more detail, it’s hard to put much faith in this number.

You also have all the features from previous Galaxy Watches, such as ECG and Blood Pressure, but especially for the last one, proceed with caution. You should know that blood pressure on the watch needs to be calibrated with a blood pressure monitor every once in a while and that might be finicky.

What is new is de novo certification for sleep apnea, meaning you can use this as an over-the-counter device for detecting sleep apnea, but it in no way guarantees accuracy.

Battery and Charging

The battery in the Galaxy Watch 7 is the same size as before — 300mAh (40mm model) and 425mAh (44mm model). However, the Exynos W1000 is built on a 3 nm process and is supposedly increasing battery efficiency by up to 50%.

The keyword here is “supposedly”. In reality, the Galaxy Watch 7 that we used barely lasted 24 hours between charges. That is disappointing!

There are no changes to charging speeds here, so expect to have your timepiece top up for about an hour every day.

As in the past, the Galaxy Watch 7 comes in two sizes: 40mm and 44mm. You also have a choice of cellular-equipped Watch 7 models, so you could go on a run without your smartphone bogging you down.

Thankfully, there is no price increase. Here are the Galaxy Watch 7 prices:

- Galaxy Watch 7 (40mm): $300 Wi-Fi only; $350 for Wi-Fi + Cellular

- Galaxy Watch 7 (44mm): $330 Wi-Fi only; $380 for Wi-Fi + Cellular

Specs

Here’s a table of the core Galaxy Watch 7 specs:

| Specs | Galaxy Watch 7 |

|---|---|

| Size and Weight | 40 mm – 40.4 x 40.4 x 9.7 mm, 28.8g 44 mm – 44.4 x 44.4 x 9.7 mm, 33.8g |

| Processor, RAM, Storage | Exynos W940 (3nm), 4GB RAM, 32GB storage |

| Software | Wear OS 5 with One UI Watch 6 |

| Battery and Charging | 300/425mAh battery capacity 15W wireless charging |

| Sensors | Accelerometer, gyro, compass, heart rate, barometer, skin temperature, blood oxygen, altimeter, ECG, geomagnetic, light |

Summary

The best Android smartwatch, now refined

The Galaxy Watch 7 is a decent spec bump, but we wouldn’t say you should rush upgrading from a Watch 6.

But it puts a welcome coat of polish and Samsung has done some great work on presenting your health and workout data in a neat way.

The big disappointment is the sub-par battery life, but we will be on the look-out for a software fix soon, so hopefully Samsung can address this issue quickly.

Should you buy it? If you are looking for a feature rich smartwatch rather than the absolute best workout watch, the answer is “yes”. From the new watchfaces to the data-rich Samsung Health app, this is in many ways the most refined smartwatch on Android. However, if you are an athlete I still think a Garmin smartwatch will work better for its slightly better accuracy and the big advantage of the week-long battery life you get on most Garmins. They also have the benefit of being compatible not just with Android phones, but with iPhones too.

The Google Pixel watches also offer a great alternative if your focus is on the smarts, with arguably more accurate heart rate measurements.

Source link