Is Vietnam losing its appeal for China’s manufacturers bypassing US tariffs?

But the 31-year-old firm that draws about two-thirds of its business from the US is making less money from Vietnam than expected, with Ren blaming a 10 per cent rise in raw material costs and a smaller increase in operating costs.

And Ren is not the only Chinese executive to have tried Vietnam to save production costs or as a workaround for US tariffs that went up in 2018 and 2019 as part of Washington’s trade dispute with Beijing.

If [the companies] don’t respond with their own increases, our companies’ profits will be impacted

He is also not the only one wondering whether Vietnam returns the promised dividend in the “China plus one” strategy, which seeks to reduce reliance on China as a production base, as companies in Taiwan face a similar situation.

“Taiwanese investors are largely making existence the priority,” said Chieh Hao-chuan, a food company operator and representative for the Council of Taiwanese Chambers of Commerce in Vietnam.

“Raw material prices are rising and increases in basic wages are a definite reality.

“If [the companies] don’t respond with their own increases, our companies’ profits will be impacted.”

For Chervon, the toolmaking supply chain in Vietnam also lags compared to China, while each Vietnamese province has its own investment rules, Ren said.

“So, we’re only crossing the river by feeling the stones. We have to take one step and look around before taking another,” he said, using the popular metaphor used by Chinese leaders to describe the path they have followed in economic reform.

Vietnam has dangled low costs for more than 15 years to attract tens of thousands of foreign-invested projects, with capital coming from Japan, Singapore, South Korea, Taiwan and mainland China.

Vietnam had grown in popularity because of rising costs in China even before the US-China trade war.

But as inflation edges up in Vietnam like much of the world, and as the Southeast Asian country also lacks the scale of China’s resources, Chinese firms like Ren’s may be particularly surprised because many have arrived just recently compared to peers from elsewhere in Asia.

“The investments needed to start production in Vietnam are not insignificant,” said Vivie Wei, Vietnam country director with Dezan Shira & Associates.

“Labour costs might look low on paper, but retention, increasing wages, generous schemes for paid leave or employer benefits need to be looked at in a way that Chinese investors are not familiar with from their own country.”

Land costs in Vietnam show a “significant upwards trend” in major cities and industrial zones because of urbanisation and demand for property, Wei said.

Over the past four years, she said, average rent had increased by 7 per cent per year in the north and 13 per cent in the south.

Labour in Vietnam costs 23 per cent less than in China, with wages as low as US$150 per month, said Ralf Matthaes, managing director at market intelligence firm IFM Research in Ho Chi Minh City.

But Chinese manufacturers, such as Chervon, may be surprised that the supply chain is less mature than that of China – a function of its relatively small economic scale – with labour being chased by multiple investors, said Frederick Burke, the American Chamber of Commerce’s Vietnam representative to the Vietnam Business Forum’s management board.

“The labour force is, while big, still a finite number and a company who can offer a higher wage will attract the workers,” said Jack Nguyen, CEO for professional services firm InCorp in Ho Chi Minh City, adding that hi-tech normally pays more than other fields.

Chervon’s frustration with uneven policies in Vietnam are common and may intensify later this year when a national land law changes, Burke added.

Some provincial authorities already delay the licencing of factory projects – in effect raising costs for investors – which is intended to appear cautious and is not a way to seek illicit financial reward, he said.

Local governments may set aside land for South Korean investors only or prioritise certain industries over others, said Winnie Lam, general secretary to the board of the Hong Kong Business Association Vietnam.

South Korea is Vietnam’s top foreign investor, while Chinese investors have registered 4,667 projects in Vietnam for a combined US$28.23 billion in capital since the late 1980s.

Americans can figure this out. I don’t know how long [investors] can do this before they say ‘hey, stop’

Proposals for factories that are labour-intensive or use older equipment receive extra scrutiny, Lam added.

And Lou Zhongping, founder of the Yiwu-based Soton Daily Necessities and dubbed the “King of Straws”, concluded that Vietnam is “not cheap” at all, with manufacturing costs 10 to 20 per cent higher than in China.

Lou recently led a group of more than 30 small and medium-sized entrepreneurs from Jiangsu and Zhejiang provinces to Vietnam for a week-long inspection tour, the state-backed Global Times newspaper reported on Saturday.

Land prices are already several times higher compared to China due to the influx of businesses from China, South Korea and Japan, he added.

The group visited Ho Chi Minh City, Da Nang and Hanoi and talked with more than a dozen Chinese and local companies.

Lou said that all the Chinese businesses he spoke to said the major reason they chose Vietnam was due to geopolitical risks.

“I have also visited many places around the world. Basically, there are few places with lower overall comprehensive costs than China. Because of China’s industrial chain advantages, no one can compete with it in the short term,” he said.

A post-pandemic drop in orders of manufactured goods from Western countries, a pullback in Vietnam’s domestic consumption and distrust in Vietnam about the quality of Chinese products further eroded some foreign investors’ profits, analysts said.

Vietnamese consumers, who represent a rising middle class, prefer Chinese brands only with “longevity, brand image and price points”, Matthaes said.

Economic planners in Hanoi have long focused on fostering value-added foreign investment, such as hi-tech, rather than the production of tools, footwear or garments.

But Vietnam remains a viable option for Chinese firms to seek to bypass US tariffs, analysts said, although the US government may eventually take action to plug that channel.

“Americans can figure this out,” Nguyen said. “I don’t know how long [investors] can do this before they say ‘hey, stop.’”

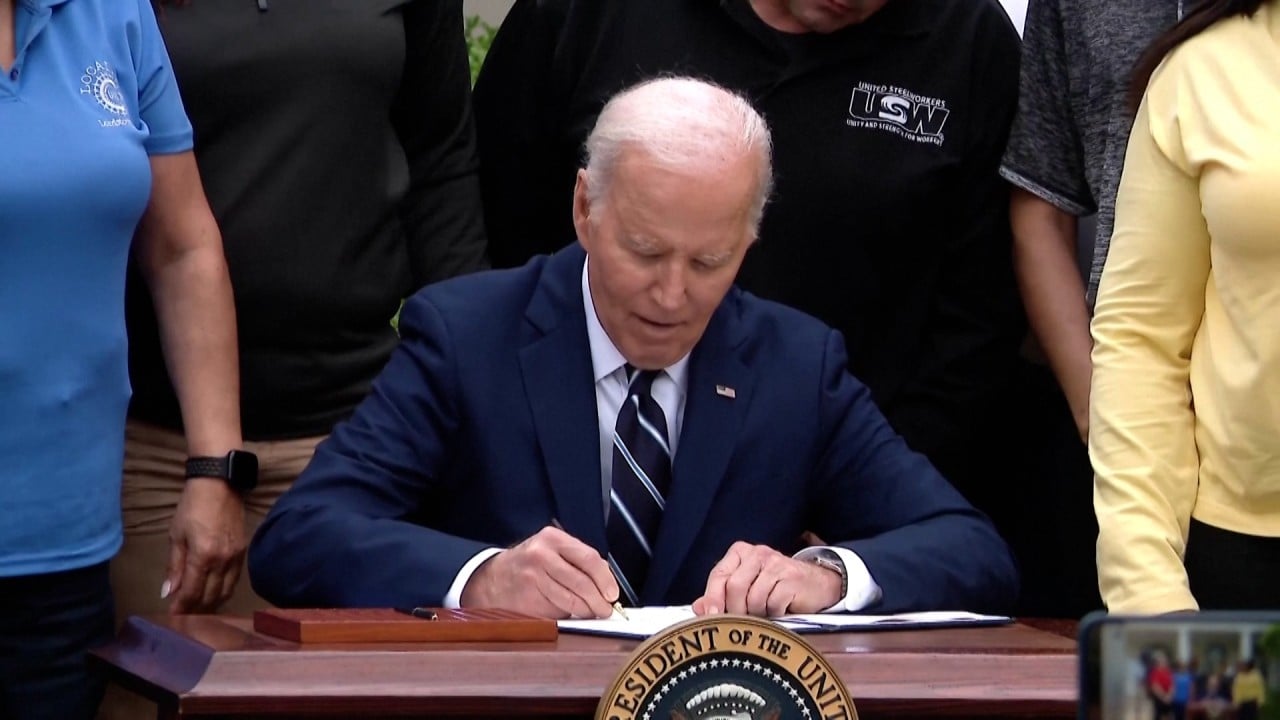

The US government already placed tariffs of more than 400 per cent on Vietnamese steel exports in 2019.

Chervon is aiming to expand investment in its Vietnam operation to US$20 million, Ren said.

“There may be some expansion in the future, but nothing is certain yet,” he said.

“Depending on the external environment, we may prepare a plan B.”

Vietnam’s Ministry of Planning and Investment data showed that the number of Chinese “newly registered projects” reached 477 in the first half of 2024 worth a combined US$1.01 billion.

They launched 233 projects in the first half of 2023 and 707 last year following 283 in 2022 and 204 in 2021.

But the story is different in neighbouring Malaysia, which traditionally attracts high-value sectors rather than traditional industries.

The approach works because of Malaysia’s relatively mature hi-tech cluster, British common law and prevalence of English-language skills, analysts said.

A tech hardware sector in the northern city of Penang has a “mature” ecosystem for semiconductors, particularly in assembly, testing and packaging, said Jaideep Singh, an analyst with the Institute of Strategic and International Studies Malaysia.

Malaysia contributes 13 per cent of all such processes worldwide, Singh said, with HP and Intel among the multinationals operating in Penang.

Manufacturing wages of about US$760 per month in Malaysia compare to US$1,100 in China, but average wages exceed China’s migrant worker average of US$680 per month, according to ING Greater China economist Lynn Song.

Bangladesh, Cambodia and Sri Lanka “are more attractive” than Vietnam for manufacturers that conduct labour-intensive and lower value-added work, said Song.

The textiles and apparel industry can thrive in the three countries, added Song.

But workers lack the skills available in Vietnam, meaning it is better for higher value added work.

Infrastructure and logistics in Bangladesh, Cambodia and Sri Lanka are also less developed than in Vietnam, which Song calls an “impediment”.

According to a study released by a group of professors at Hong Kong Polytechnic University, Renmin University in Beijing, Australian National University and Singapore Management University in May, only 20 per cent of transactions from 343 buyer-supplier relationships surveyed since 2018 had been diversified.

The trend of ‘China plus one’, however, won’t stop and manufacturers will find an equilibrium for the long term

“Low-tech industries are easier to find replacements of suppliers. It would be harder for hi-tech industries [to diversify],” said Fan Di, associate professor and assistant dean in fashion and textiles at the Hong Kong Polytechnic University.

“Firms sometimes can’t find their cooperating partners if clusters are not yet developed.”

But Fan added that companies see tariffs and geopolitics as “evolving crises and long-term uncertainties”, while they are balancing diversification and complexities when considering the China plus one strategy by comparing whether moving parts of their operations out of China is cheaper than absorbing the tariffs.

“The trend of ‘China plus one’, however, won’t stop and manufacturers will find an equilibrium for the long term,” he said.

“It’s about how many per cent of their operations should stay in China and how many per cent should move out to other places that can help optimise efficiency and product development.”

Additional reporting by Kandy Wong

Source link