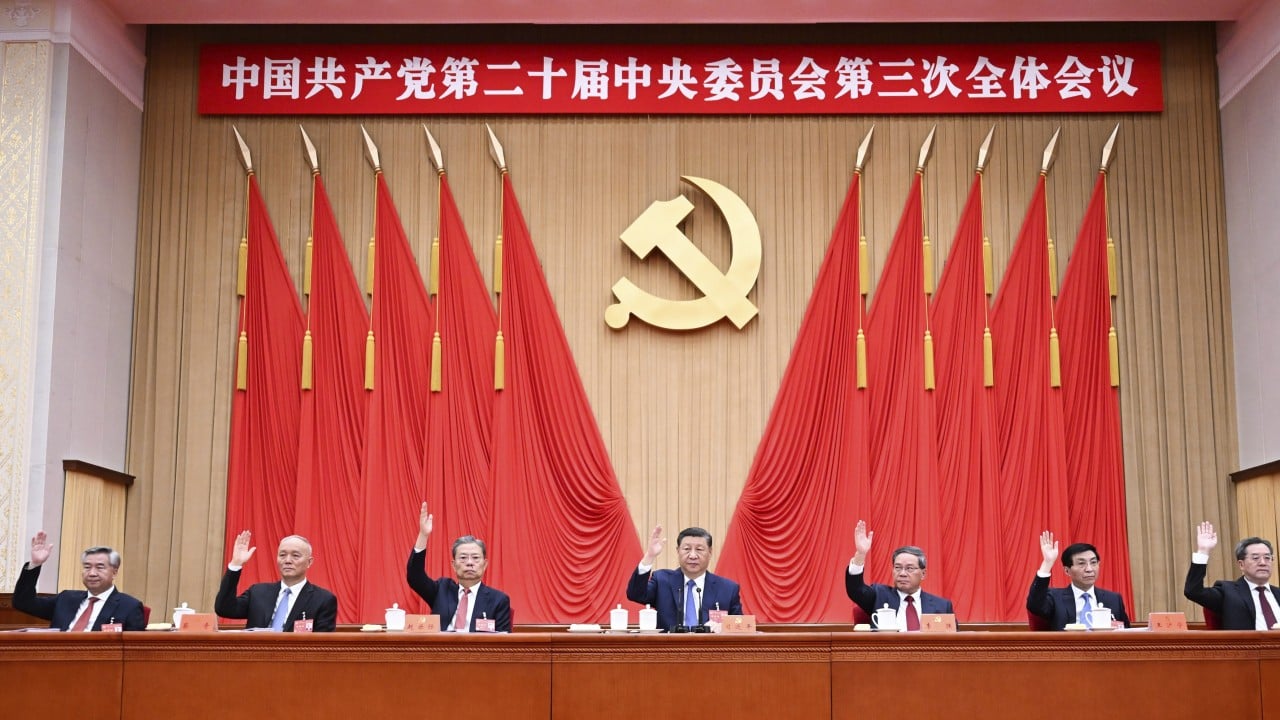

Has China, after long-awaited third plenum, given its market a demotion?

The use of “better leverage” in reference to the role of the market at the twice-a-decade event – formally known as the third plenum of the party’s 20th Central Committee – slightly deviates from rhetoric used at the same gatherings in 2013 and 2018, when the market was granted a “decisive role” in resource allocation.

It is “a question of balance” in terms of managing the roles of the market and government intervention in the economy, said Ding Shuang, chief economist for Greater China at Standard Chartered Bank.

“Compared with the past, it may signal that we should not entirely rely on the market, and emphasise the need to make up for market failures,” Ding said.

‘Better leverage’ is not as strong as ‘decisive force’

The benchmark Shanghai composite index opened 0.46 per cent lower. China’s central bank, meanwhile, set daily yuan reference rate at 7.1315 per US dollar on Friday, compared to 7.1285 a day earlier.

Laying out a broad blueprint for the building of a “high-standard socialist market economy” by 2035, the communique also urged action in areas like fiscal, taxation, finance and urban development, without unveiling details.

The communique also set a time limit for the fulfilment of the plenum’s mandates – 2029, the 80th anniversary of the founding of the People’s Republic of China.

But it was the language around the market’s role that garnered the most attention from analysts and observers.

“‘Better leverage’ is not as strong as ‘decisive force’,” said Bert Hofman, a professor at the East Asian Institute of National University of Singapore.

According to the communique, a scientific approach to governance should be employed to both “lift restrictions” and “maintain order” in the market.

“Even if we talk about ‘maintaining order’, we must regulate with market-oriented methods and rules, otherwise risks may arise,” Ding said.

Zhu Tian, a professor of economics at the China Europe International Business School, said the logic expressed in the aftermath of the plenum is that market mechanisms and the role of the government are unified and complementary.

“The role of the market cannot be overemphasised or unilaterally emphasised. But market players certainly hope that the market will play a greater role,” Zhu said.

Denis Depoux, global managing director at German consultancy Roland Berger, said the new terminology indicates a modified outlook rather than a sea change.

“Let’s not over-interpret the absence of the word ‘decisive role’”, he said.

“Commitment to marketisation is clear, even in sectors close to strategic national interests. [There will be] more party and government intervention. [But] intervention is back for similar reasons in truly capitalist economies.”

Other, sterner forms of intervention have had markets and investors spooked over their China exposure as of late.

These objectives are often mentioned, but many hope they can be enshrined in law for specific and implementable legal guarantees and protection

In recent years, crackdowns in a variety of sectors – tech, education and finance to name a few – have sent a chill through foreign and private capital that policymakers have struggled to thaw.

Entreaties for overseas investment from officials earlier this year – intended to dispel those worries – were reflected in the communique.

The document pledged equal access to “factors of production” for entities with “all forms of economic ownership”, participation in the market on “equal footing” and under equal protection by the law.

“These objectives are often mentioned, but many hope they can be enshrined in law for specific and implementable legal guarantees and protection,” Zhu said.

A law tailor-made for the private sector, he added, is more meaningful than the mantra-like repetition of such pledges in official statements.

Unlike past plenums – which have tended to focus on the long term and structural reforms – committee members stated they were “firmly committed” to achieving the goals for economic development in 2024, including a previously set 5 per cent target for gross domestic product growth.

Anxieties like these were given significant space in the communique, with “preventing and defusing risks” stressed in the management of “real estate, local government debt, small and medium financial institutions” and other areas.

“It shows that the central government still attaches great importance to this goal,” Ding said.

“But [as] they didn’t indicate additional stimulus, it is more about better implementation of existing stimulus measures.”

Weak domestic consumption, coupled with low confidence in the private sector, have further frustrated Beijing’s efforts to retool its economic structure to focus more on the domestic market – an endeavour made more pressing by growing uncertainty on the world stage.

In the meantime, US restrictions on China’s access to cutting-edge technology – including advanced semiconductors – are likely to intensify further, frustrating Beijing’s quest for sustainable sources of economic growth fuelled by technological advancement.

To counterbalance these points of tension, the communique read, China should “strive to play a leading role in global governance”, “actively work to foster a favourable external environment” and “enhance the resilience of industrial and supply chains”.

Tianchen Xu, senior China economist at the Economist Intelligence Unit, said the initial document from the third plenum is a continuation of existing strategy.

“There’s nothing hinting at China heading towards a different policy direction,” Xu said.

“We think any market-oriented reform will be measured and carried out, insofar as it doesn’t compromise national security.”

Innovation and productivity gains trump all other priorities before the “grand backdrop” of US-China rivalry, he added.

“There will be a ‘Chinese approach’ to this – not through market-oriented reforms, but through key performance indicators around innovation or the mandatory adoption of domestic technologies.”

Source link