Exclusive | Chinese exporters said to be ditching shipments mid-voyage to avoid crushing Trump tariffs

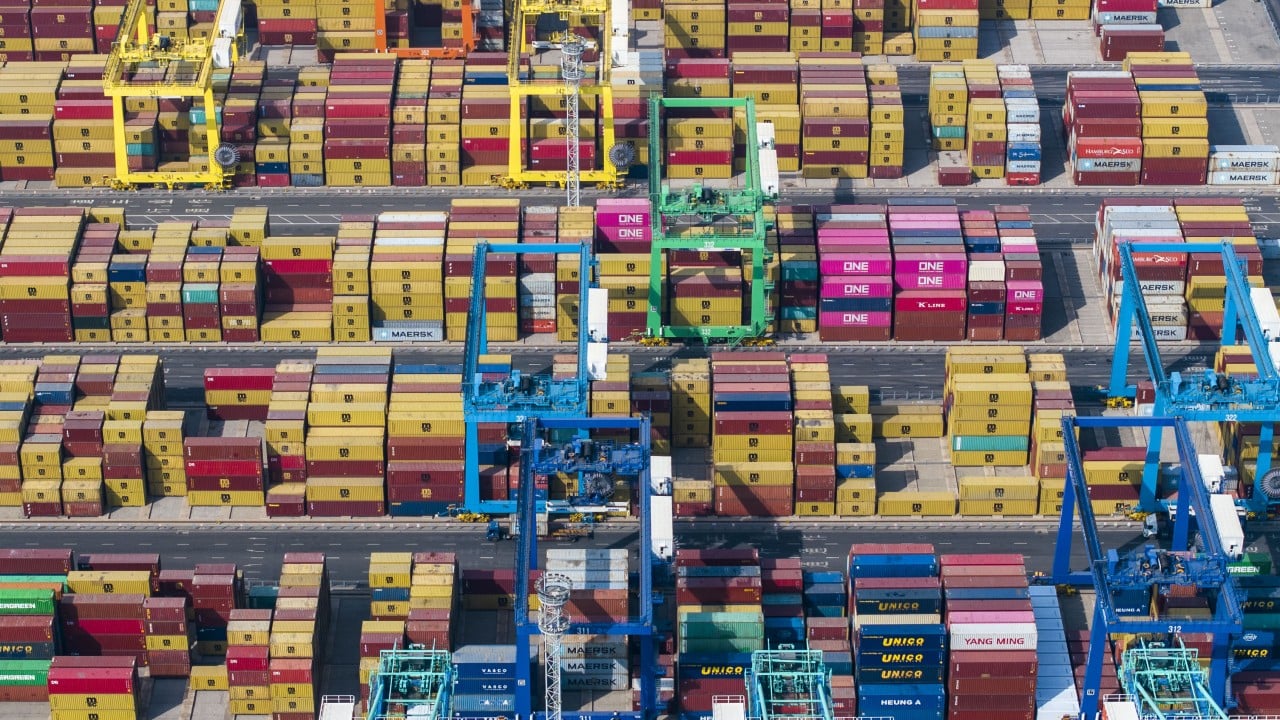

Amid escalating trade tensions between China and the United States, some Chinese exporters are taking the drastic step of ditching shipments mid-voyage and surrendering containers to shipping companies to avoid crushing tariff costs.

Industry insiders have dubbed the move “preparing for the Long March”, a grim metaphor for what many see as a prolonged and punishing downturn in cross-Pacific trade.

A staff member at a China-listed export company, who requested anonymity, said its US-bound container volume had plummeted from 40 to 50 containers a day to just three to six as a result of the new tariffs on Chinese imports imposed by the second Trump administration. It has increased tariffs by 104 per cent this year, taking the total impost to around 115 per cent.

The new tariffs have triggered a backlash from Beijing and sent shock waves through global markets, fuelling fears that a full-scale trade war is about to break out.

“We’ve halted all shipping plans from the Philippines, Vietnam, Indonesia and Malaysia,” the employee said. “Every factory order is halted. Anything that hasn’t been loaded will be scrapped, and the cargo already at sea is being re-costed.”

One client had told the company it was abandoning goods already on the water and giving them to the shipping company, as “no one will buy them after the tariffs are imposed”.

The company’s leadership had returned to China to manage a flood of order cancellations and had instructed its staff to suspend all container business until tariffs stabilise or alternative markets are secured.

Source link