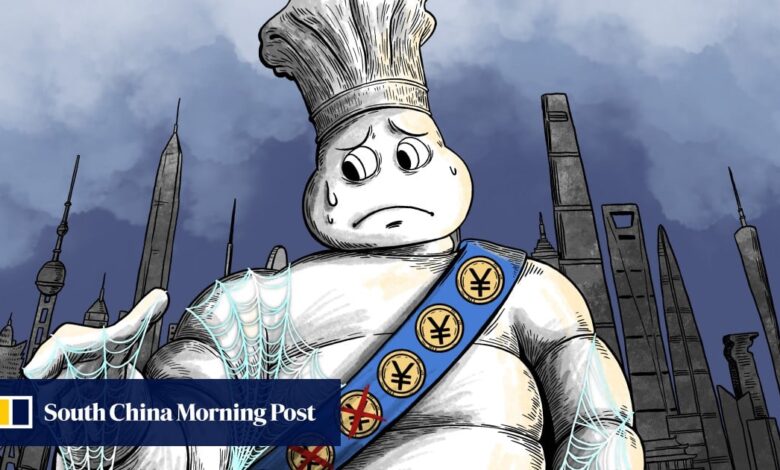

China’s fine dining scene darkens as economic clouds blot out Michelin stars

Even with an average price of 600 yuan (US$83) per person, the dining room was always bustling. And Rive Gauche, the hotel’s French restaurant, rarely saw an empty table despite an average price surpassing 1,000 yuan a head.

“In the past, some customers might have dined out once a week or two. Now, they might only opt for fine dining once a month. Many others have shifted to cooking at home or going out for something simpler,” said Basil Yu, the hotel’s executive chef and supervisor of both restaurants.

Reservations are no longer a hot commodity, with diners easily securing tables at the last minute. And those who do sit down for a meal are keeping a close eye on their budgets.

“Previously, people were willing to spend 600 yuan to 700 yuan on a bottle of wine. Now, those same customers prefer buying two bottles of wine for the same money,” Yu said.

That chill is being felt across the board. Several high-end restaurants with an average cost of over 1,000 yuan per person have shut down since last year, and a place in a storied guide like Michelin has been no guarantee of safety.

Shanghai, China’s most prosperous market for high-end dining, has seen the worst of the downturn.

As of June, the city had around 1,854 restaurants with an average per-person cost of over 500 yuan – twice the count of Beijing, three times that of Shenzhen, and four times the number in Guangzhou – according to canyin88.com, a food industry data provider.

Since last April, the proportion of Shanghai restaurants with that average spend shrank from 1.44 per cent to 0.8 per cent, with over 900 establishments closing their doors.

“Over the past few years, especially during the pandemic, incomes at all levels have fallen in China and the already small customer base that could frequent fine dining restaurants has been shrinking, with their dining frequency also in decline,” said Huang Geng, a committee chairman at the World Federation of Chinese Catering Industry, a non-governmental organisation that promotes the country’s food sector worldwide.

“Many of them have left the country or opted for overseas options as international travel resumed after the pandemic.”

Huang, also founder of Huang Ji Huang – a chain of Chinese restaurants with over 600 locations worldwide – said the earlier rise in high-end dining establishments could be attributed to those who faced career setbacks in recent years turning to the restaurant industry for new opportunities.

Others have jumped into the fray with a lack of foreknowledge, Huang said, believing running a restaurant is easy and has a low barrier to entry. This has made for fiercer competition to retain a shrinking customer base – and for a staff to service their needs up to expectations.

Even the wealthiest in the country have felt the chills of the economic downturn and cut down banquet expenses

“Although the number of high-end restaurants has increased, chefs capable of making high-end cuisine in China are extremely rare,” Huang added.

“If these chefs are poached by newly opened restaurants, the quality of the menu [declines]. This is also one of the reasons for the high closure rate.”

The fall in fine dining outposts may also be a reversion to the mean after a change in habits prompted by years of pandemic controls. During that time, diners gravitated to high-end restaurants and their more private, lower-capacity spaces as more traditional eateries fell afoul of Covid-19 restrictions on indoor crowds.

A widespread spending and income downgrade of this nature is not something that can be reversed quickly, Huang said, and the recovery of the market will take some time.

“I think the number of high-end dining establishments will continue to fall, and people may have to brace for tough times ahead,” he added.

Sales of other luxury products have seen similar slides. Monthly Swiss watch exports to China – the second-biggest market after the US – plunged 42 per cent in March and then extended their decline in April and May, although at slower rates.

Jay Li, a shareholder of a luxury restaurant in Guangzhou which can charge anywhere from 1,000 yuan to 2,000 yuan per customer, said revenues in 2024 have plummeted 30 or 40 per cent compared with last year.

“Even the wealthiest in the country have felt the chills of the economic downturn and cut down banquet expenses,” Li said, adding it was once common for patrons to top up their accounts to the tune of as much as 300,000 yuan (US$41,436), but those cash infusions are now few and far between.

Despite the losses, Li said he would not compromise on service to save on expense, choosing to maintain previous standards, while others have opted to lower prices to attract more business.

A restaurant in Beijing’s central business district, for example, had to slash prices by roughly 60 per cent in the beginning of 2024 to bring in customers – a per-person average of 250 yuan, down from 650 yuan.

For restaurants barely staying afloat, their main strategy is to optimise and streamline operations with minimal staffing, as rent costs are fixed while labour expenses are more flexible.

But cost-cutting measures like these have not gone unnoticed. Comments have increased on social media about lacklustre service, even at restaurants with Michelin stars or other honours, damaging reputations further and sending patrons packing.

“Even well-established, top-tier restaurants have started lowering prices, running promotions and getting more competitive, so we have to follow suit to stay in the game,” said He Yuqian, co-owner of Qingxiang, a national chain of Hunan cuisine restaurants.

One of five across the country, the Beijing location has a commanding view of the CCTV Tower – one of the capital’s iconic architectural landmarks – but even this prized vista has not been enough to keep tables occupied at earlier rates.

Qingxiang counts business groups and corporate banquets as its major moneymakers, but as companies struggle in an economic slowdown and tighten their budgets to ease the financial strain, discretionary spending on lavish events is being curtailed.

“Fewer people are dining out, and many companies have lowered their expense limits – meals [estimated to cost] over 300 yuan per person on Dianping are no longer reimbursed,” He said, referring to China’s most popular restaurant rating and review app.

After the pandemic, [people are] not as carefree with their money as they used to be. Money feels more valuable, and everyone is being more cautious

The number of people per table has dropped, he added, from 10 or more people at a table to a maximum of five most nights. Revenues at his restaurants, all in the mid to high price range, have dropped 20 to 30 per cent on average.

“After the pandemic, [people are] not as carefree with their money as they used to be. Money feels more valuable, and everyone is being more cautious,” He said.

“These days, people just want to eat their fill, as opposed to eating well.”

Ma Shen, deputy general manager of a new energy equipment company headquartered in Guangzhou, also confirmed a dwindling demand for business feasts.

“Last year, our company spent more than one million yuan (US$138,121) on banquets, including drinks,” he said.

“Usually, we would choose a banquet package that costs about 500 yuan per person, not counting drinks. But this year it might be a third less than last year, because the number of project contracts is far lower than expected.”

Going forward, industry insiders said competition in the fine dining sector will only heighten, as gourmets now have an expanding array of domestic options and a greater selection of dining experiences abroad, many of which come at a lower cost.

“The real challenge now is the lack of hope. Rent remains as high as before, and during the pandemic, we thought things would get better once it was over – there was at least a glimmer of hope,” said He of the Qingxiang restaurant chain.

“But in the current economic climate, it’s hard to predict when things will turn around.”

Others, such as Yu of the Puxuan Hotel, remain more optimistic. An increase in foreign visitors, he said, would boost high-end dining and local consumption in general.

“When we travel abroad, we want to splurge on a meal at a fine dining restaurant,” Yu said. “It’s the same when foreign tourists visit China.”

But that number still lags behind pre-Covid levels, as 15.53 million visited in the first half of 2019.

Additional reporting by He Huifeng

Source link