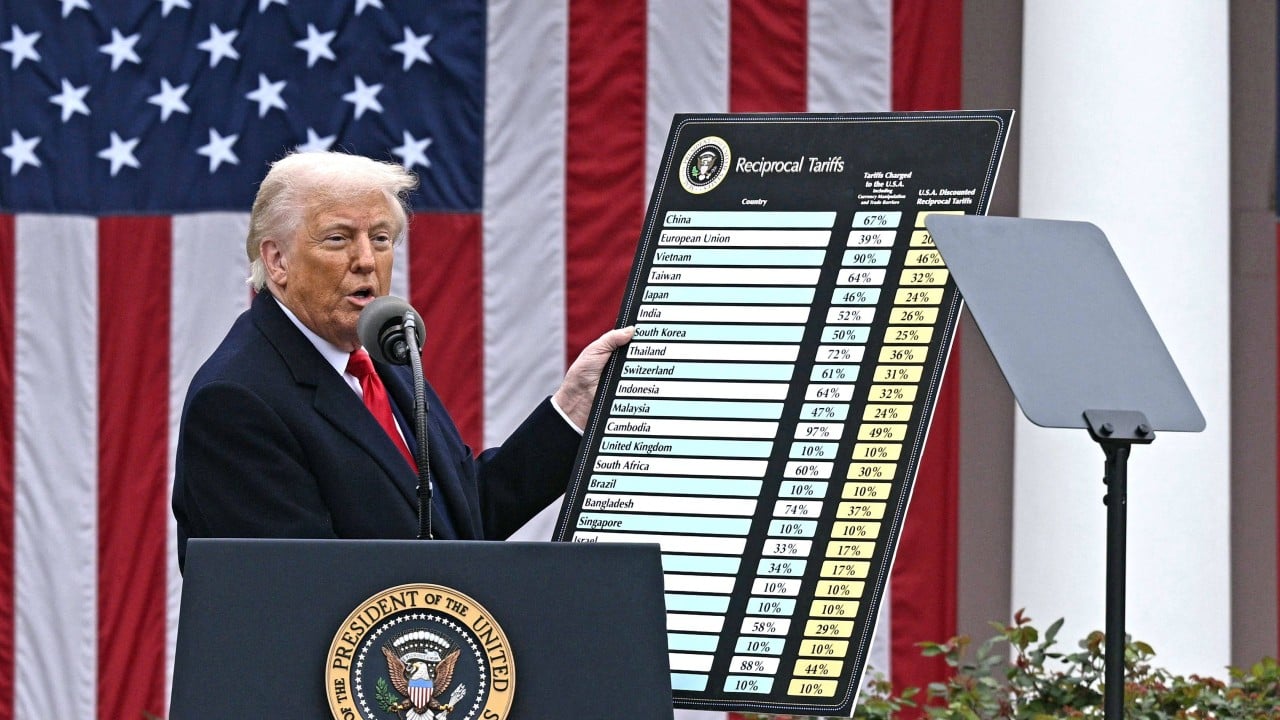

China battles to stabilise yuan after Trump’s tariffs spark market upheaval

China’s central bank set the fixing rate for the yuan against the US dollar at its lowest level since January on Thursday, as the Chinese currency came under pressure following US President Donald Trump’s reciprocal tariff hikes.

Gold prices surged to a record high on Thursday as investors sought a safe haven, prompting Chinese regulators to issue a warning about market volatility.

The People’s Bank of China (PBOC) set Thursday’s yuan fixing rate – also known as the midpoint rate – at 7.1889 per US dollar, the lowest level since January 17, following a sell-off of the offshore yuan.

But the fixing rate is still much stronger than the offshore market level, which indicates “the PBOC’s efforts and strategy to stabilise the yuan remain unchanged”, said Raymond Yeung, chief Greater China economist at ANZ Bank.

The offshore yuan had dropped to 7.349 against the US dollar earlier in the day, its lowest level since early February, following the news that the United States planned to raise tariffs on Chinese imports by 34 per cent.

By midday on Thursday, the offshore yuan had strengthened slightly to trade at 7.306 per US dollar.

Source link