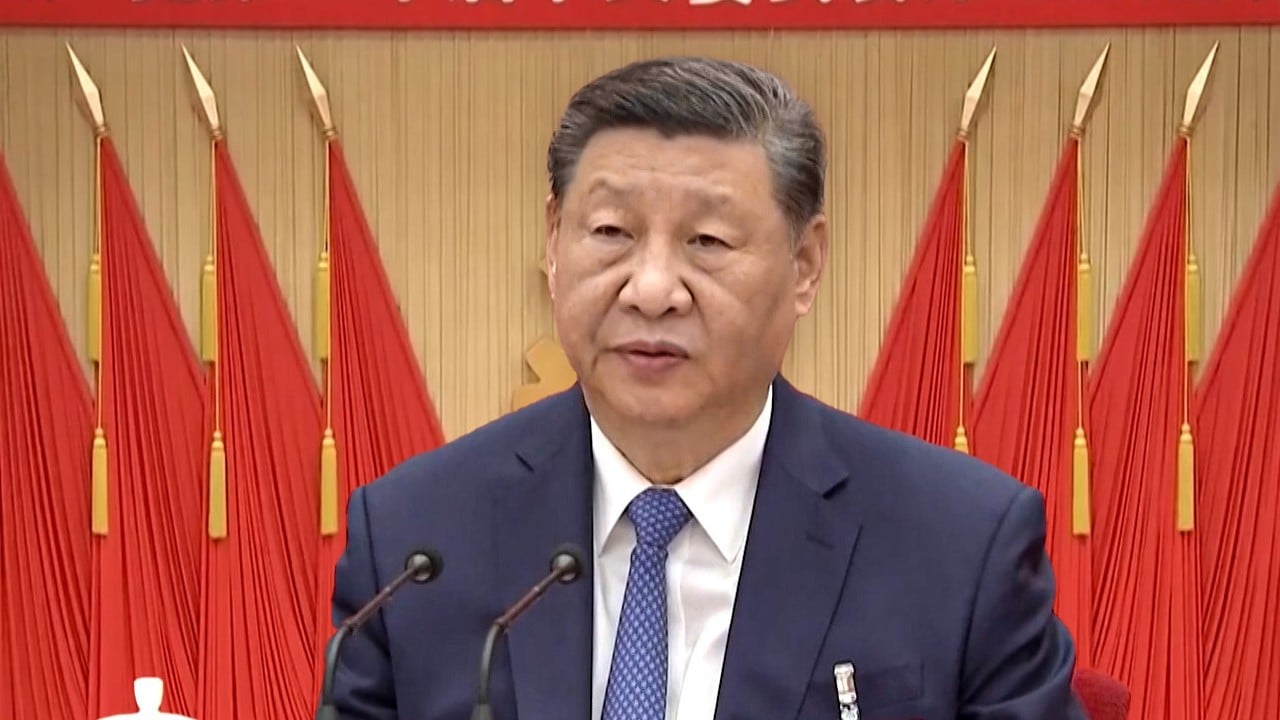

Can China’s Politburo ‘break the deadlock’ on economic growth as half-year comes in focus?

The world’s second-largest economy posted a 5 per cent year-on-year increase in GDP in the first half of the year. Still, momentum took a hit as year-on-year growth in the second quarter decelerated to 4.7 per cent, and as quarter-on-quarter growth slowed to 0.7 per cent, official figures suggested.

Compared with the third plenum, “the Politburo meeting at the end of July will have a more direct impact on market expectations of fundamentals”, analysts from Citic Securities said in a note on Sunday.

In a rare departure from the tradition of focusing on long-term goals, the communique of the third plenum stressed that China must “unwaveringly strive to finish this year’s growth targets”, underscoring leadership’s acknowledgement of the present difficulties.

Zhao Xijun, a finance professor at Renmin University in Beijing, said there could be more details from the meeting on how the government is supporting the large-scale equipment renewal and consumer goods trade-in initiatives announced earlier this year.

“This is a very task-specific meeting, and officials will check how things are going and decide what adjustments are to be made in consideration of the full-year goal,” he said.

He said that consumption stimulus should play a leading role in policies for the rest of the year, because “if consumption picks up, it will bring up expectations, and investment will also increase”.

With the housing crisis being a persistent source of pressure, authorities may take more actions in this regard, but nothing huge, according to Xu Tianchen, a senior China economist with the Economist Intelligence Unit.

“There should be further liquidity and demand-support for the housing market, although the current government doesn’t have a track record for aggressive stimulus,” he said.

It’s getting hard for China to turn the tide

Darius Tang, associate director of corporates at Fitch Bohua, agreed that given the clear statement and determination conveyed at the third plenum, the Chinese government will introduce more targeted stimulus policies, including “increasing support for real estate trade-in programmes and cutting interest rates on existing housing loans”.

“We believe the Chinese government has fully recognised the headwinds faced by the economy and has expressed a strong willingness to proactively boost domestic demand,” he said.

Both Xu and Tang expected further monetary policy easing after the People’s Bank of China unexpectedly cut the short-term policy rate and the mortgage-reference rate on Monday to support the economy.

In addition to low confidence in the housing market despite rescue measures, China’s economic woes include greater signs of deflation in many areas – an issue more difficult to tackle than inflation, according to Liu Zhiqin, a senior researcher with Renmin University’s Chongyang Institute for Financial Studies.

China’s consumer price index, a key gauge of inflation, saw year-on-year growth of 0.2 per cent in June, continuing more than a year-long stretch of weakness, official data showed.

July’s Politburo meeting, following reform plans laid out at the third plenum, will be more of an occasion to “stabilise confidence and show more composure” instead of issuing “new groundbreaking policies”, Liu noted.

“It’s getting hard for China to turn the tide,” he said.

But there are still opportunities to be seized, he added, citing investment in water infrastructure as a major source of GDP growth for the second half of the year, as unprecedented floods hit regions across the country.

“There have been serious floods this summer. Increased investment should be expected in the construction of new water-conservancy projects and the reinforcement of related facilities, which will exert an instant effect in pushing up GDP,” he said.

One issue that may be discussed at the upcoming meeting, but not necessarily be trumpeted, could be a pre-planning of China’s economic strategy in response to the United States’ looming presidential election, said Shi Lei, a professor of economics at Fudan University.

“We must consider how the new [US] president will affect us,” he said. “After all, the Chinese economy still relies greatly on the external market.”

Source link