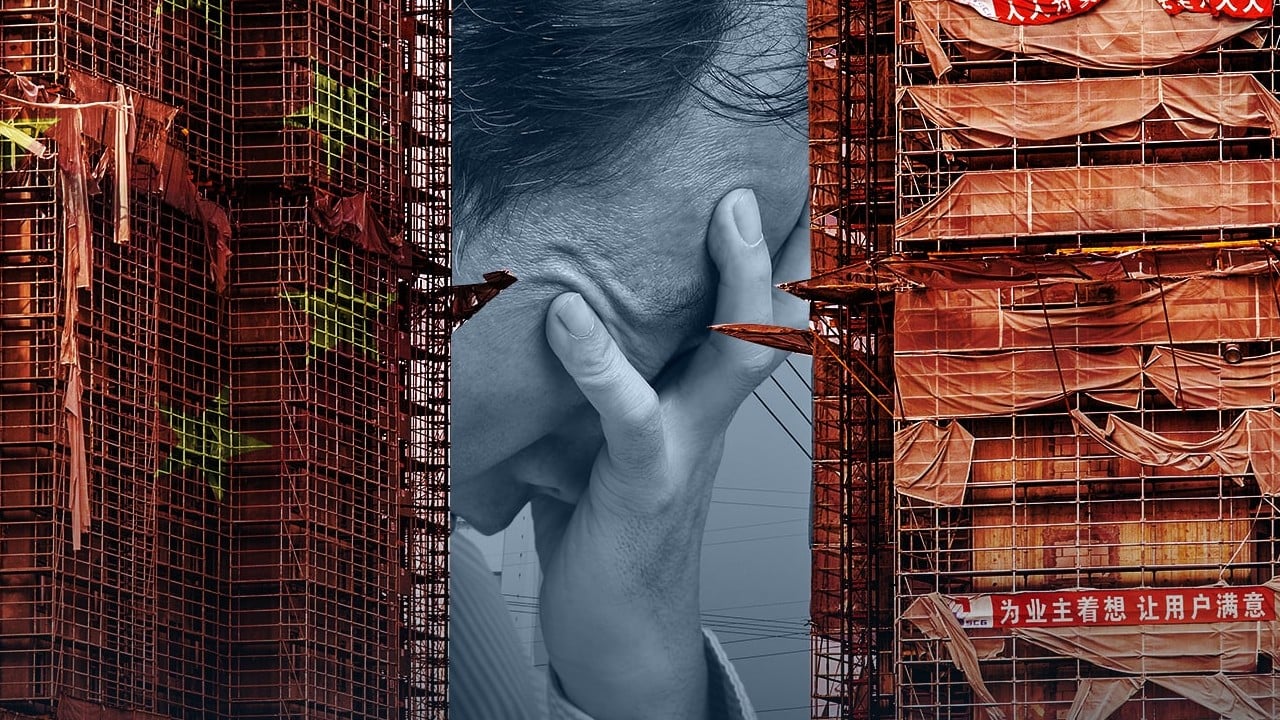

China’s housing sector could be mired in a slump despite possible rescue measures: analysts

More measures to revive China’s property sector and the economy are likely at this month’s Politburo meeting, after the third plenum pledged to overhaul the industry, according to analysts.

But the property sector will continue to be a drag on economic growth and is unlikely to see any improvement soon, considering the challenges to restore consumer confidence and weak demand, they warned.

Though no new policies to prop up the property sector have been unveiled, the central government reiterated its resolution to “accelerate the construction of a new model of real estate development” following the third plenum, a twice-a-decade event to outline the economic blueprint for the next five years, according to the full text of the meeting released by Xinhua News Agency on Sunday.

Beijing’s pledge to reform the sector includes revamping financing methods and the presale system, as well as improving the property tax, the document showed. Additionally, it called for an “integrated urban-rural development”, adding to market bets on a potential revamp to the hukou or household registration system, and urban and rural resources.

Han Wenxiu, executive deputy director of the office of the Central Committee for Financial and Economic Affairs, told a press conference on Friday that an ongoing urbanisation process will “offer space for high-quality development in the real estate sector”.

“The overall tone of the statement indicates a clear desire for a new real estate model going forward, one that is more centred around affordability and ensuring that the mass market segment has [homes] to live in,” said Michael Chang, head of Asia financials at CGS International.

“Policymakers wish to change the model of property developers raising funds from homebuyers by selling projects before they are built,” he said, adding that concerns about social stability have prompted policymakers to prioritise unfinished projects.

“The rise in unfinished real estate projects and slowing sales have pressured the presale system to shift towards selling completed properties,” said Wang Xingping, a senior analyst at Fitch Bohua.

“Some cities have begun piloting this policy, but developers face significant financial pressure, slowing the transition. With improved financing conditions and changing buyer demand, the completed property sales model is expected to expand further,” she added.

The communique suggests that policymakers are concerned about weak domestic demand and may “step up easing rhetoric and measures” at the coming July Politburo meeting, Goldman Sachs analysts led by Shan Hui said in a report.

The US investment bank last Wednesday adjusted down the property sector’s contribution to the country’s gross domestic product (GDP) to minus 1.5 percentage points from the previous minus 1.2 percentage points, slightly bigger than the 2023 level, citing links between house prices and consumer confidence, consumption and financial spillovers.

It also cited the lacklustre economic data released last week, including year-on-year GDP growth of 4.7 per cent for the second quarter, as well as mild improvement in home prices.

“The impact on the real economy may take a few more years to fully pass through, given the length of time it takes to complete construction projects,” Goldman Sachs said. “Property prices continue to fall and have not shown signs of stabilisation.”

Source link