China puts tax reform in sights as leaders mull government’s role in alleviating pressure

China’s new tax-reform plans decided at this week’s third plenum will focus on raising income for local governments, as well as support from the central government, in response to the financial difficulties facing many regions, a senior Communist Party official said on Friday.

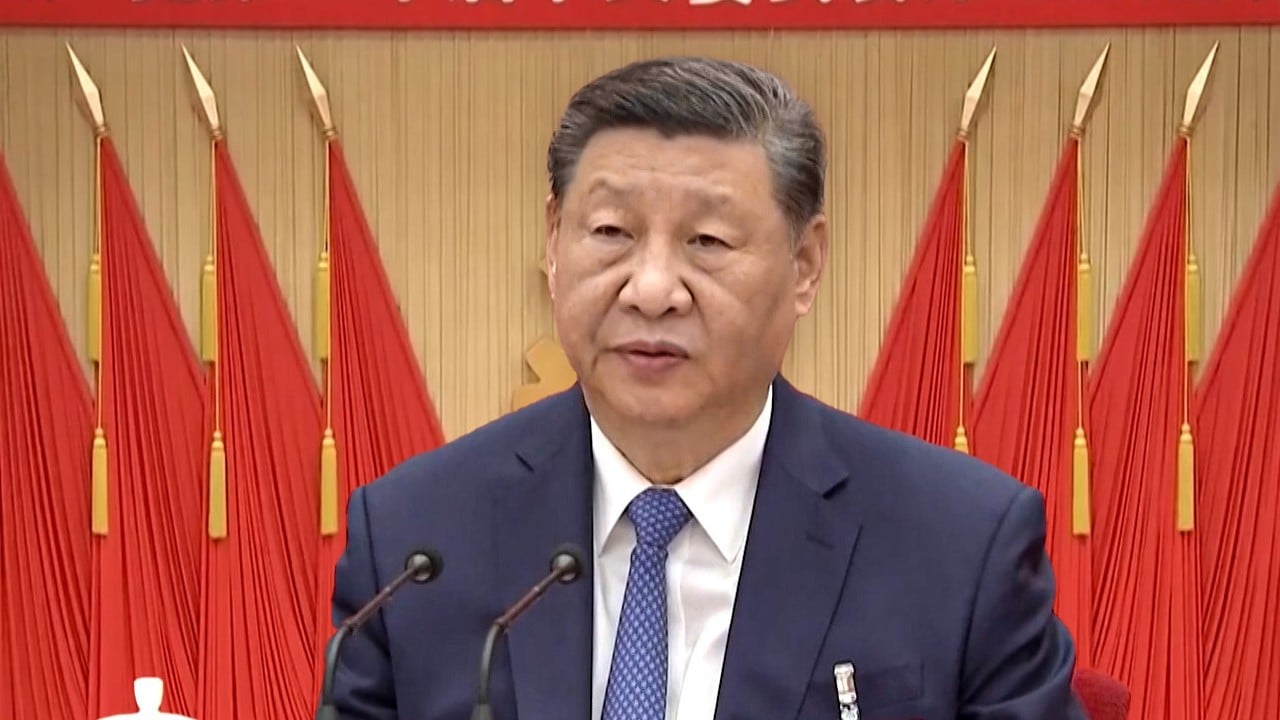

“In response to the financial difficulties of local governments and grass-roots organisations, it has been proposed to improve the financial relationship between the central and local governments,” Han Wenxiu, deputy director of the Office of the Central Financial and Economic Affairs Commission, said at a news conference in Beijing.

The reforms include increasing local governments’ autonomous fiscal capacity, expanding their tax sources, improving the matching of financial resources at lower levels of local governments and addressing their spending needs, appropriately strengthening the responsibility of the central government and raising its fiscal spending obligations, Han said.

“It is necessary to study a corresponding tax system that is compatible with the new sectors,” he said, without elaborating. “After more than 40 years of rapid development, our country’s wealth has continued to accumulate.

“The communique requires exploring national balance-sheet management, optimising various structures, and making adjustments.”

The need for local fiscal and tax reform is one of more than 300 reform directives to be outlined in an official resolution document expected in the coming week, and it is one with high urgency given the country’s snowballing debt and waning revenue from the property market.

Luo Zhiheng, chief economist at Guangzhou-based Yuekai Securities, said the plans included in the communique should help alleviate the short-term financial pressure facing many local governments, while also laying a foundation that supports the nation’s economic growth.

“The ideas and measures on fiscal and tax reform put forward at the third plenum are highly targeted, and they are aimed at solving problems and making changes,” Luo said.

China’s local governments have been under mounting debt pressure from a widening gap between spending and income, raising risks of defaults that threaten broader ramifications for the economy.

In 2023, general public budget expenditures among China’s local governments hit 23.6 trillion yuan (US$3.25 trillion), exceeding the national general public budget revenue of 21.7 trillion yuan, and local general public budget expenditures accounted for 86.1 per cent of the total, Luo said.

Exploring how the national balance sheet is managed would also help constrain debt expansion while revitalising resource assets, Luo added.

And with land sales remaining under pressure, policies that better balance the fiscal responsibilities across different levels of government will be important to ensure the sustainable delivery of services, said Harry Murphy Cruise, an economist at Moody’s Analytics.

“On top of that, a broader tax base will allow for more countercyclical spending to support local areas during downturns,” Murphy Cruise added.

The Chinese government prefers to push through changes in a gradual and controlled manner

Wenyin Huang, director of international public finance ratings for S&P Global Ratings, expects more details – such as changes in revenue-sharing arrangements between central and local governments, and changes in shifting expenditure responsibilities – to come in due course.

“We think a more balanced local government fiscal position means less new debt being raised, thereby contributing to more controlled debt growth,” Huang said.

However, she added, “we do not expect the developments to induce drastic changes to local fiscal balances”.

“As we’ve seen from past fiscal reforms, the Chinese government prefers to push through changes in a gradual and controlled manner,” Huang noted.

Han also said on Friday that the stable, healthy development of the property market must be promoted, while admitting that the sector’s supply-and-demand relationship is undergoing major changes.

“The sector is large in scale and involves a wide range of other industries, with a systematic impact on the entire economy,” Han said.

Han said the policy combination – digesting the stock and optimising the increment – is key in implementing Beijing’s policies. “We must ensure the delivery of new homes to buyers and better utilise the stock of unsold homes as well as land resources,” he explained.

On the implementation of plenum decisions, Han said a new model of property sector development must be promoted to address the inadequacies of the sector’s “high debt, high turnover, high leverage” model of the past. He also stressed that corresponding financing, taxation, land, sales and other new supporting systems must be established.

Source link