Why jewellery remains a shining investment during troubled times – in the year Drake paid US$1 million for Tupac Shakur’s crown ring

“This makes it a great investment during periods of economic uncertainty,” said Andrew Shirley, partner, and head of rural and luxury research at Knight Frank.

The KFLII, which tracks price movements across 10 key asset classes, dipped slightly into negative territory for only the second time ever as the luxury market cooled from record highs.

“Not all categories of the jewellery market are under pressure,” said Jonathan Abram, brand director at jewellery house Ronald Abram.

“The collectable rare jewels we specialise in have consistently held their value.”

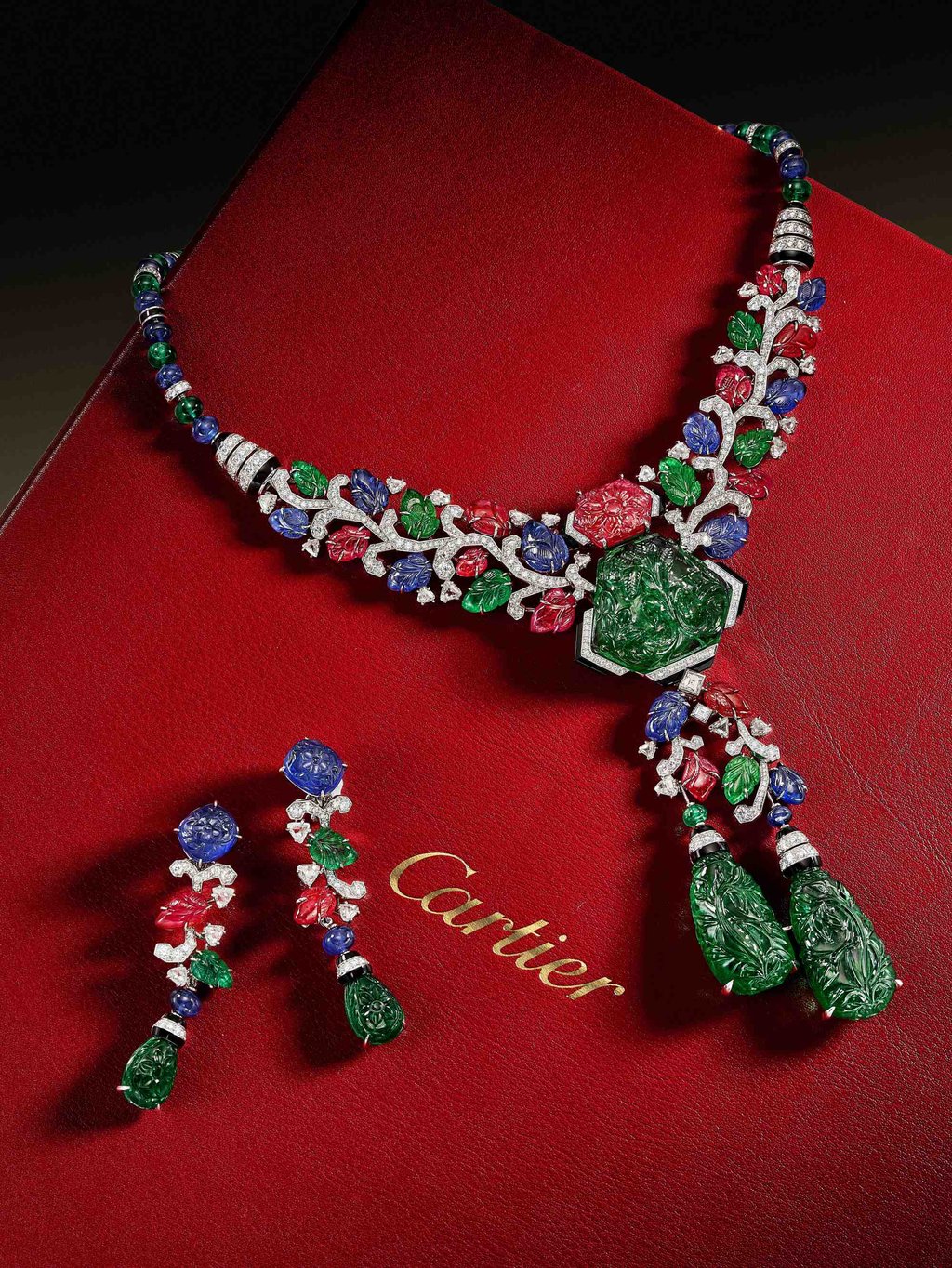

Collectors are gravitating towards natural-coloured untreated gemstones, such as Burmese rubies, Kashmir sapphires and Colombian emeralds, according to Abram. There is also growing interest in estate jewellery, particularly signed pieces from well-known international jewellers.

“Collectors are primarily drawn to rarity. Other factors including fine workmanship, strong design and the portable nature of jewellery also drive interest.”

While price gains slowed overall in most categories of the KFLII by year end, Shirley said the luxury market is simply digesting excesses after a prolonged bull run.

“Jewellery is without doubt the oldest investment of passion and is valued by societies all over the world,” he said. “This fascination and constant innovation from jewellery makers will ensure future opportunities.”

The stellar performance of jewellery shows that certain luxury segments remain insulated from broader economic turbulence. The steady rise of coloured diamonds also offers hope, with higher-saturation shades and smaller cuts in demand.

Shirley thinks demand for jewellery as a whole will remain strong through 2024 despite macroeconomic turbulence.

“The spending power of middle-wealth individuals in certain countries like China is under pressure, but the number of ultra-high-net-worth individuals increased in 2023,” he said. “There is still plenty of money around, and I believe demand for jewellery will remain buoyant.”

Source link